Buying Off-Plan Real Estate in Dubai

Are you considering investing in the vibrant real estate market of Dubai? Off-plan real estate purchases can be an excellent option for buyers looking to secure their dream property in this dynamic city. In this article, we will explore the concept of buying off-plan real estate, discuss its advantages, and provide essential guidance on how to navigate the process successfully.

Introduction

Dubai's real estate market has been attracting investors from around the world due to its impressive growth and promising returns. Buying off-plan properties, also known as pre-construction or under-construction properties, involves purchasing a property before its completion. This means that buyers have the opportunity to invest in a property that is yet to be built, offering potential benefits and risks.

Understanding Off-Plan Real Estate

Off-plan real estate refers to properties that are sold by developers before they are fully constructed or even commenced. Buyers essentially purchase a promise of future ownership, based on the plans and specifications provided by the developer. This approach allows developers to secure the necessary funding for the project and gives buyers the advantage of purchasing at potentially lower prices compared to ready-to-move-in properties.

Advantages of Buying Off-Plan Real Estate

1. Capital Appreciation Potential: One of the primary advantages of buying off-plan real estate is the potential for capital appreciation. As the property is typically purchased at a lower price during the pre-construction phase, buyers can benefit from future price increases as the project progresses and upon completion.

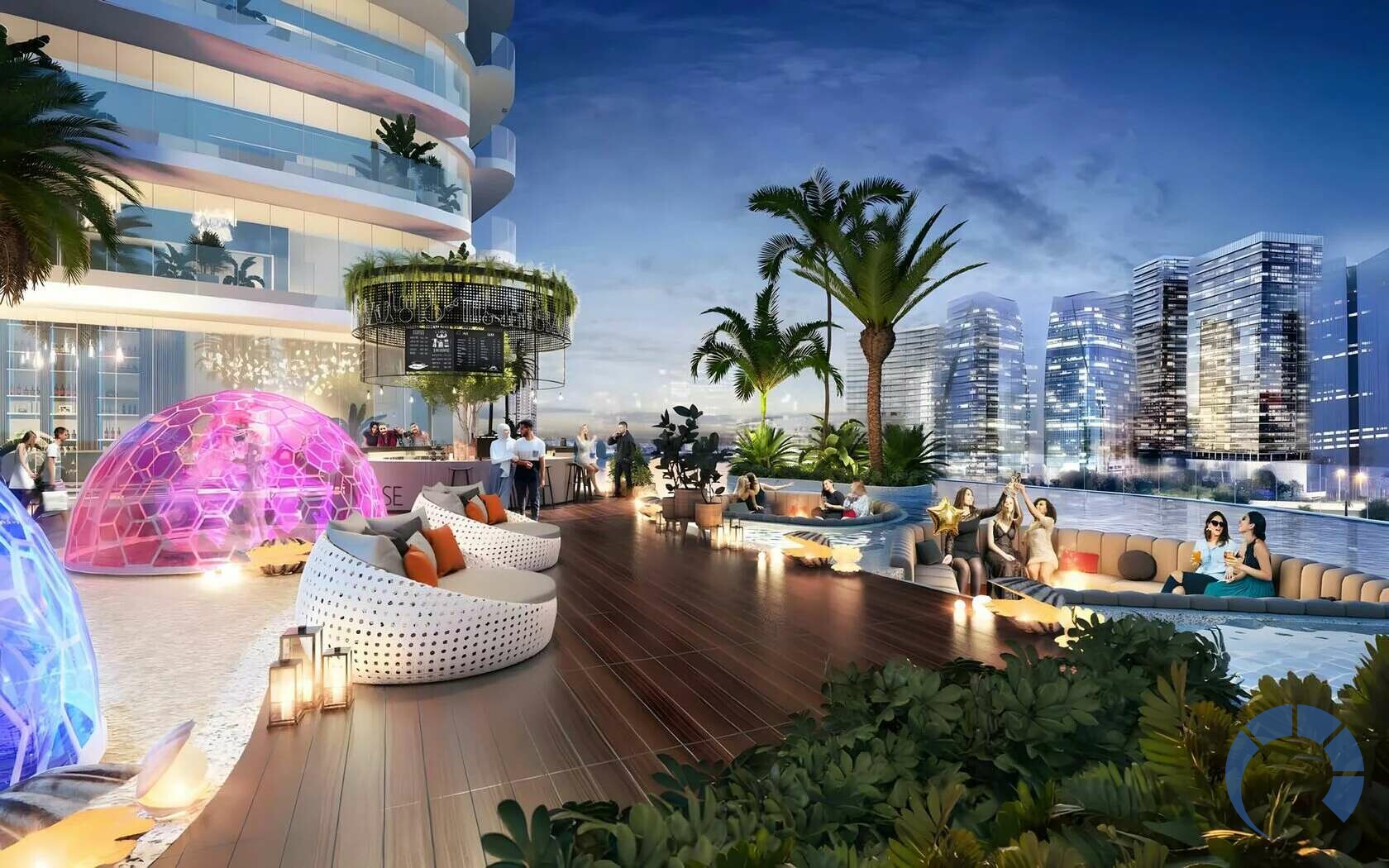

2. Modern Designs and Amenities: Off-plan properties often feature contemporary designs and the latest amenities. Developers strive to offer attractive and innovative features to attract buyers and compete in the market, making off-plan properties an appealing choice for those seeking modern living spaces.

3. Flexible Payment Plans: Developers often offer flexible payment plans for off-plan properties, allowing buyers to spread their payments over the construction period. This can make it more affordable for buyers to invest in their desired property without immediate full payment.

4. Early Selection and Customization: Buying off-plan allows buyers to select their preferred unit from the available options and sometimes even customize certain aspects such as finishes or layouts. This level of personalization adds value and enhances the overall buying experience.

Factors to Consider Before Buying Off-Plan Real Estate

Researching the Market and Developers

Before making an off-plan purchase, it's crucial to conduct thorough research on the real estate market in Dubai. Stay updated on market trends, upcoming developments, and demand-supply dynamics. Additionally, research and evaluate the reputation, track record, and financial stability of the developers involved in the project.

Legal and Financial Due Diligence

Engage a reputable real estate lawyer to review the legal aspects of the off-plan property purchase. Ensure that all necessary permits, approvals, and contractual agreements are in place. Perform financial due diligence to ascertain the financial health of the developer and ensure that the project is adequately funded.

Evaluating the Location

Consider the location of the off-plan property carefully. Assess factors such as proximity to essential amenities, transportation links, future infrastructure projects, and

potential for growth. A desirable location increases the property's value and rental potential in the long run.

Examining the Developer's Track Record

Review the developer's track record in terms of completed projects, delivery timelines, and quality of construction. Check for any past disputes or issues that may impact the development and delivery of the project.

Assessing the Project Specifications

Examine the detailed specifications of the off-plan property, including floor plans, architectural designs, materials, and fixtures. Ensure that the property meets your requirements and aligns with your expectations.

Understanding Payment Plans and Milestones

Understand the payment structure and milestones defined by the developer. Review the terms and conditions regarding payment schedules, installments, and penalties for delays. Clarify any ambiguities or concerns before proceeding with the purchase.

Potential Risks and Mitigation Strategies

Off-plan purchases carry inherent risks, such as delays in construction, changes in market conditions, or project cancellation. Mitigate these risks by carefully reviewing the developer's reputation, engaging legal advice, and assessing the market demand for the project.

Government Initiatives and Regulations

Stay informed about the relevant government initiatives, regulations, and policies concerning off-plan real estate in Dubai. Understand the legal framework, ownership rights, and investor protection measures in place to ensure a secure investment.

Financing Options for Off-Plan Properties

Most developers provide payment plans. Some developers provide post-handover payment plans. However, if you are looking to take a mortgage after you get the property, in the case, developer is not offering any payment plan, explore financing options available for off-plan properties in Dubai. Consult with banks and financial institutions to understand the loan eligibility criteria, interest rates, and repayment terms. Assess your financial capacity and choose a suitable financing option.

Finalizing the Purchase

Once you have conducted thorough due diligence and are satisfied with the off-plan property, it's time to finalize the purchase. Review the contract, seek legal advice, and negotiate terms if necessary. Make the required payments according to the agreed-upon payment plan and milestones.

Buying off-plan real estate in Dubai presents an exciting opportunity for investors to acquire a property with potential capital appreciation and modern amenities. However, it requires careful research, due diligence, and an understanding of the risks involved. By following the outlined factors and considerations, buyers can make informed decisions and maximize the benefits of investing in off-plan properties.

FAQ

1. Are off-plan properties more affordable compared to ready-to-move-in properties?

Yes, off-plan properties are generally priced lower than ready-to-move-in properties, offering buyers the potential for capital appreciation.

2. How can I assess the reputation of a developer before buying an off-plan property?

You can assess a developer's reputation by reviewing their track record, completed projects, and customer reviews. Engaging a real estate agent or conducting online research can provide valuable insights.

3. What happens if the off-plan property construction gets delayed?

Delays in construction are possible, and developers may have provisions for such situations in the purchase agreement. Ensure you understand the developer's policy regarding delays and the available remedies.

4. Can I customize an off-plan property according to my preferences?

In some cases, developers allow buyers to customize certain aspects of off-plan property, such as finishes or layouts. Check with the developer to confirm the customization options available.

5. How do I finance the purchase of off-plan property in Dubai?

You can explore financing options from banks and financial institutions in Dubai. Consult with them to understand the eligibility criteria, interest rates, and repayment terms for off-plan property financing.

Related posts:

Discover PHOREE Real Estate, led by Munawar Abadullah with 30 years of American Wall Street expertise, and learn how our AI-driven insights empower smart investments in Dubai's hotel and real estate markets. PHOREE Real Estate, Munawar Abadullah, hotel investment, Dubai...

Discover the consequences for developers in Dubai who fail to meet handover dates and learn the legal actions buyers can take. This comprehensive guide covers penalties, compensation claims, regulatory intervention, and the steps to take before filing a legal complaint....