How to Evaluate a Hotel Investment: A Comprehensive Guide

Investing in hotel real estate is a nuanced endeavor—one that demands a sophisticated understanding of both the hospitality industry and real estate valuation. This guide, crafted with three decades of industry insight and written in a style reminiscent of the Financial Times and The Chicago Manual of Style, offers an in-depth exploration of how to evaluate a hotel investment. We present a balanced narrative that is both persuasive and expository, employing David Ogilvy–inspired headings and Wikipedia‐style organization to elucidate complex concepts with clarity and precision.

Introduction

The notion of buying or selling a hotel is far from a typical weekend project. Unlike standard residential or commercial properties, hotels present unique operational, financial, and market challenges that require a specialized investment approach. Whether you are considering entering the market, actively engaged in a transaction, or simply conducting research, understanding how to evaluate a hotel investment is crucial.

This guide addresses the following critical questions:

- What distinguishes hotel real estate from other property types?

- Which key performance indicators (KPIs) are vital for assessing hotel performance?

- How do market dynamics and guest demographics drive hotel success?

- What are the primary valuation methodologies, and how do you apply them?

- How do you mitigate risk while maximizing return?

Through contextual storytelling, detailed examples, and methodical analysis, we provide a clear framework to help you navigate the complexities of hotel investments.

Understanding the Unique Nature of Hotel Real Estate

Hotel Real Estate: More Than Brick and Mortar

Hotel properties differ significantly from conventional real estate assets. While all real estate comprises tangible assets—land, buildings, and associated improvements—hotels are intrinsically tied to daily operational dynamics. Unlike a residential property with a one-year lease or a long-term office building, hotels operate on a nightly rental model. This operational difference translates into an elevated sensitivity to market fluctuations and seasonal variations.

Key Points:

- Dynamic Revenue Model: Hotel revenue is based on short-term occupancy, with room rates adjusted daily according to demand.

- Operational Complexity: Beyond the property itself, the guest experience, service quality, and amenities play central roles in a hotel’s success.

- Capital Flexibility: Hotels can quickly adapt to market trends by scaling operations, initiating renovations, or repositioning their services.

Understanding these operational nuances is vital for any investor asking, “how to evaluate a hotel investment” in today’s competitive market.

Categories of Hotels and Their Investment Implications

Hotels are segmented into various categories based on service levels, amenities, and target markets. Recognizing these differences helps investors align their strategies with market realities.

Full-Service Hotels

- Description: Offer comprehensive services including on-site dining, spas, meeting rooms, and concierge services.

- Examples: Four Seasons, St. Regis, Marriott, Hilton.

- Investment Impact: High operational costs balanced by premium pricing, yet vulnerable during economic downturns.

Select-Service Hotels

- Description: A middle ground with a blend of essential services and limited luxury amenities.

- Examples: Hilton Garden Inn, Courtyard by Marriott.

- Investment Impact: Lower operational costs with moderately high occupancy, offering a balanced risk profile.

Limited-Service Hotels

- Description: Focus on providing basic lodging without extensive amenities like restaurants or banquet facilities.

- Examples: Comfort Inn, Hampton Inn.

- Investment Impact: Cost-effective with lower profit margins, yet attractive for investors targeting stable, budget-conscious markets.

Extended-Stay Hotels

- Description: Cater to long-term guests with suite-style rooms featuring kitchen facilities.

- Examples: Embassy Suites, Hilton’s Homewood Suites.

- Investment Impact: Consistent revenue from extended stays, reducing the volatility seen in daily occupancy models.

Budget Hotels

- Description: Prioritize cost reduction and minimal service offerings.

- Examples: Days Inn, Travelodge.

- Investment Impact: Lower purchase prices and operating costs, but with limited revenue potential and higher competition.

Understanding these segments is essential for investors to answer, “how to evaluate a hotel investment” with the right lens for operational expectations and market positioning.

Key Performance Indicators (KPIs) and Metrics in Hotel Valuation

Average Daily Rate (ADR) and Revenue Per Available Room (RevPAR)

Evaluating a hotel investment requires a keen grasp of its financial performance metrics. Two of the most critical KPIs are the Average Daily Rate (ADR) and the Revenue Per Available Room (RevPAR).

- Average Daily Rate (ADR):

Calculated by dividing the total room revenue by the number of rooms sold over a given period, ADR measures the average income generated per occupied room.

- Revenue Per Available Room (RevPAR):

RevPAR provides a more holistic view by incorporating both occupancy and room rates. It is determined by multiplying the ADR by the occupancy rate, or by dividing total room revenue by the total number of available rooms.

These metrics allow investors to benchmark performance against competitors and adjust their strategies accordingly.

Tracking and Benchmarking Performance

Hotel operators and investors frequently analyze daily, weekly, and annual RevPAR trends to assess market performance. Comparing a hotel's RevPAR with that of similar properties in the same market offers insights into competitive positioning. This method is essential when considering the question, “how to evaluate a hotel investment” from a revenue perspective.

Important Considerations:

- Competitive Set Analysis: Evaluate how a hotel's performance stacks up against comparable properties.

- Seasonal Adjustments: Account for demand fluctuations during peak and off-peak periods.

- Operational Efficiency: Assess profit margins and the impact of management practices on cost control.

Market Dynamics and Demand Drivers

Consumer Segments: Business Travelers and Tourists

The success of any hotel is largely driven by its ability to attract the right mix of guests. Two primary consumer groups underpin most hotel revenues:

- Business Travelers:

Demand driven by corporate travel peaks during weekdays. Hotels located near business centers and convention facilities tend to perform strongly during these periods. - Tourists:

Leisure travel typically drives demand on weekends and during holiday seasons. Hotels in resort destinations or near major attractions capitalize on this trend.

Seasonal and Event-Driven Demand

Beyond the basic consumer segments, hotel demand is also influenced by seasonal trends and local events. For instance:

- Seasonal Peaks: Ski resorts witness high occupancy in winter, while beach resorts peak in summer.

- Event-Driven Spikes: Hotels in proximity to convention centers or major event venues can expect significant demand surges during conferences, sports events, or cultural festivals.

Investors must carefully analyze local market dynamics when exploring how to evaluate a hotel investment. The ability to forecast and adapt to these demand drivers is key to ensuring long-term profitability.

Initiating Your Hotel Investment Journey

A Strategic Approach to Market Entry

Embarking on a hotel investment journey requires meticulous research and a strategic mindset. Investors should avoid decisions based solely on personal preference or attractive guest experiences. Instead, a systematic approach is necessary:

- Comparative Analysis:

- Evaluate ADR and RevPAR among comparable hotels within the same market.

- Use these metrics to identify properties that demonstrate both strong historical performance and future growth potential.

- Operational Efficiency:

- Assess the property’s profit margins and management capabilities.

- Consider the cost structure and potential for operational improvements.

- Pricing Strategy:

- Compare the market price with projected future earnings. A budget hotel acquired at an attractive price may outperform a premium property purchased at a high premium.

- Factor in potential tax benefits, such as accelerated depreciation on furniture and fixtures.

- Risk Management:

- Consider market volatility and the inherent risks associated with the hospitality industry.

- Use historical data and industry benchmarks to gauge the stability of cash flows.

By adhering to these steps, investors can build a robust foundation for making informed decisions on how to evaluate a hotel investment.

Analyzing the Competitive Landscape

Conducting due diligence is paramount. Look into the hotel’s proximity to key venues—hospitals, office complexes, entertainment hubs—and review the local economic indicators such as employment rates, consumer confidence, and retail growth. These factors collectively influence a hotel’s performance and, by extension, its valuation.

Valuation Methodologies: Unraveling the Complexities

Determining the value of a hotel involves an assessment of future cash flows, operational efficiency, and market trends. Investors typically employ three broad valuation approaches:

1. Income Capitalization Approach

The income capitalization approach hinges on the principle that a hotel’s value equals the present worth of its future income streams. The most common method within this approach is the Discounted Cash Flow (DCF) analysis.

- Discounted Cash Flow (DCF) Analysis:

This method requires projecting the hotel’s revenue, expenses, and net cash flows over a period—typically 5 to 10 years—and then discounting those cash flows to their present value using a discount rate that reflects the investment’s risk profile.

Steps:

- Estimate Future Cash Flows: Project room revenues, food and beverage income, and other ancillary earnings.

- Select a Base Year: Use historical performance data as a benchmark.

- Apply a Discount Rate: The rate should account for market risk and expected return.

- Calculate Terminal Value: Estimate the hotel's value beyond the forecast period.

Example:

Consider a hotel with an annual net operating income (NOI) of $500,000 and a discount rate of 10%. If cash flows are projected over 10 years with an assumed terminal value calculated at year 10, the DCF model aggregates the present values of these cash flows to arrive at a comprehensive valuation.

2. Cost Approach

The cost approach determines a hotel’s value based on the cost to replace or reproduce the asset, adjusted for depreciation. While useful for understanding the break-even point between building and buying, this method does not account for income potential.

- Calculation Method:

- Replacement Cost: Estimate the cost to rebuild the hotel (excluding land value).

- Depreciation: Subtract accumulated depreciation from the replacement cost.

- Add Land Value: Include the current market value of the land.

This approach is particularly relevant when considering whether to invest in an existing hotel or develop a new property.

3. Sales Comparison Approach

Perhaps the most intuitive method, the sales comparison approach relies on market data. It involves comparing the subject hotel with recent sales of similar properties in the same market.

- Methodology:

- Gather Data: Collect recent transaction data for comparable hotels.

- Adjust for Differences: Account for variations in property size, location, amenities, and condition.

- Derive Price Per Room (PPR): Divide the total sales price by the number of rooms to yield a standardized metric.

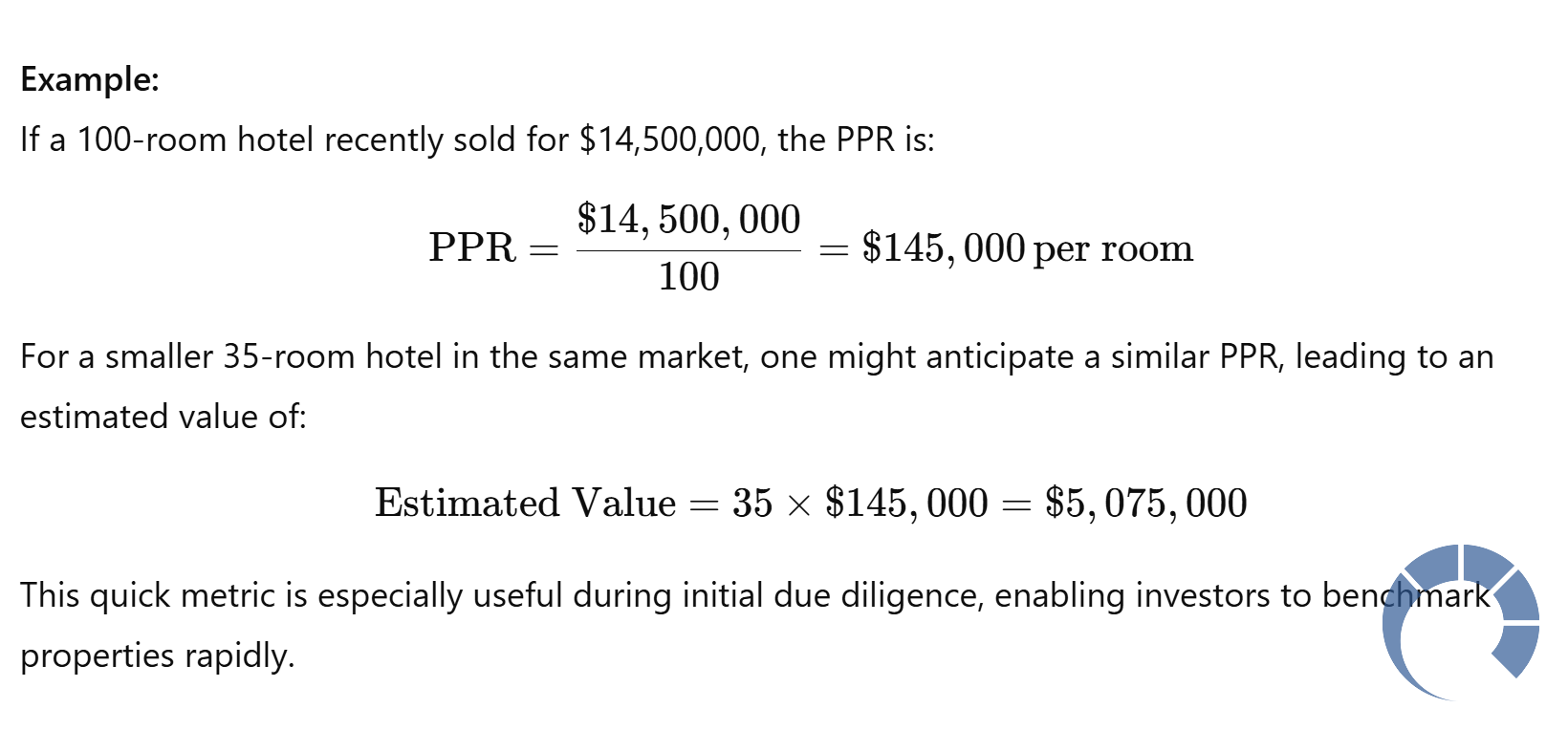

Example:

Suppose a 100-room hotel recently sold for $14,500,000, equating to a PPR of $145,000. For a 35-room hotel in a similar market, the estimated value would be approximately:

This method is particularly useful for a “quick and dirty” valuation, providing a baseline for further analysis.

Additional Valuation Techniques and Curiosities

Beyond these primary approaches, industry experts sometimes employ unconventional rules of thumb. For instance:

Though these methods offer intriguing insights, they serve primarily as curiosity checks rather than rigorous valuation tools.

Advanced SEO Considerations for Hotel Investment Content

To rank higher on search engines for the keyword “how to evaluate a hotel investment,” it is imperative to integrate advanced SEO strategies. Consider the following tactics:

- Keyword Density and Placement:

Ensure that “how to evaluate a hotel investment” appears in headings, subheadings, and throughout the content without over-optimization. Strategic placement within introductory and concluding paragraphs enhances relevance. - Internal and External Linking:

Embed hyperlinks to authoritative sources. For example, reference this detailed hotel valuation method to provide readers with additional context and bolster the article’s credibility. - Rich Media Integration:

Incorporate infographics or charts comparing ADR, RevPAR, and other KPIs to visually engage readers and increase dwell time. - Semantic Variations:

Use related keywords such as “hotel valuation techniques,” “hotel investment analysis,” and “assessing hotel performance” to capture a broader audience without diluting focus. - Content Structure:

Organize the article using Wikipedia-style headings and bullet points to enhance readability and improve search engine indexing.

By melding persuasive narrative with technical precision, this guide not only informs but also aligns with modern SEO best practices to boost online visibility.

Discounted Cash Flow Analysis: A Closer Look

Unpacking the DCF Model for Hotel Valuation

The Discounted Cash Flow (DCF) model is revered as one of the most accurate methods for evaluating a hotel investment, as it incorporates both current performance and future potential. Here’s a step-by-step breakdown:

- Establish the Base Year:

Use historical financial data to set a benchmark. For instance, if a hotel recorded a net operating income (NOI) of $500,000 last year, this figure becomes your starting point. - Project Future Cash Flows:

Forecast the hotel’s revenue streams for the next 5 to 10 years. Consider factors such as occupancy rate improvements, inflation, and potential operational efficiencies. - Determine the Discount Rate:

The discount rate reflects the risk profile of the investment. For a moderately risky hotel property, a rate of 8%–10% is common. This rate adjusts future cash flows to their present value. - Calculate the Terminal Value:

At the end of the forecast period, estimate the hotel’s sale value based on prevailing market conditions or an exit multiple derived from industry standards. - Sum the Present Values:

Add the present values of projected cash flows and the terminal value to determine the hotel’s overall valuation.

Example:

Assume the following simplified projections for a hotel:

- Year 1 NOI: $500,000

- Annual Growth Rate: 5%

- Discount Rate: 10%

- Forecast Period: 10 years

- Terminal Multiple: 8 times Year 10 NOI

By calculating the present value of each year’s NOI and the terminal value, investors derive a precise estimate of how to evaluate a hotel investment based on its future earnings potential.

The Role of Sensitivity Analysis

A critical component of DCF is sensitivity analysis. Given the uncertainties inherent in forecasting, varying key assumptions such as occupancy rates, ADR, or discount rates provides a range of potential outcomes. This analysis not only highlights the best-case and worst-case scenarios but also informs risk mitigation strategies.

Comparative Market Analysis: Leveraging Historical Data

Price Per Room (PPR) as a Benchmark

A straightforward and often utilized method in hotel investment evaluation is the Sales Comparison Approach, particularly by analyzing the Price Per Room (PPR).

- Step-by-Step Process:

- Identify recent sales of hotels within the same market.

- Calculate the PPR by dividing the total sale price by the number of rooms.

- Adjust for differences in location, condition, and operational performance.

Beyond the Numbers: Qualitative Factors

While quantitative methods are essential, qualitative factors often determine the final investment decision. Consider the following:

- Location: Proximity to transportation hubs, entertainment, and business centers.

- Brand Reputation: The intrinsic value of a well-known hotel brand can drive both occupancy and pricing power.

- Management Expertise: Effective operational management can translate into higher profitability and smoother guest experiences.

- Market Trends: Local economic conditions, tourism trends, and competitive dynamics influence long-term performance.

An integrated analysis that blends numerical data with qualitative insights ensures a comprehensive approach to how to evaluate a hotel investment.

Final Considerations: The Roadmap to a Successful Hotel Investment

Synthesizing the Key Elements

Investing in hotels requires balancing complex operational metrics with market realities. To summarize:

- Understand the Unique Nature of Hotels: Recognize that hotels differ from other real estate assets due to their dynamic revenue models and operational complexities.

- Utilize Robust KPIs: Focus on metrics like ADR and RevPAR to gauge performance.

- Embrace Multiple Valuation Methods: Employ the income capitalization, cost, and sales comparison approaches to triangulate a hotel’s true market value.

- Incorporate Market Intelligence: Use both quantitative data and qualitative insights to assess location, brand strength, and management quality.

- Conduct Thorough Due Diligence: Analyze historical performance and future projections with tools like DCF and sensitivity analysis.

A Persuasive Call to Action

For investors ready to step into the world of hotel real estate, the rewards can be substantial. However, the journey begins with a solid foundation of knowledge and a methodical approach to valuation. By understanding how to evaluate a hotel investment through meticulous analysis and leveraging industry-standard metrics, you are better positioned to make informed decisions that maximize both profitability and personal satisfaction.

We invite you to further explore detailed valuation methodologies and practical tools by visiting this comprehensive hotel valuation guide. Whether you are an experienced investor or a newcomer to the hospitality sector, ongoing education and professional advice are indispensable to navigating this complex market.

Conclusion

In a world where every investment decision is intertwined with risk and reward, understanding how to evaluate a hotel investment is not merely an academic exercise—it is a strategic imperative. With a clear grasp of operational intricacies, performance metrics, and valuation methodologies, investors can confidently navigate the dynamic landscape of hotel real estate.

By synthesizing rigorous quantitative analysis with qualitative market insights, you will be well-equipped to assess the true potential of any hotel investment opportunity. The fusion of advanced SEO techniques, persuasive narrative, and technical detail in this guide is designed to empower you with the knowledge necessary for sound investment decisions.

Embark on your hotel investment journey with diligence, creativity, and the assurance that every figure, forecast, and operational detail contributes to a compelling case for success. Ultimately, whether you are buying, selling, or simply evaluating a hotel investment, a well-informed strategy is your most valuable asset.

For those looking to invest in hotels or Dubai’s thriving real estate market, PHOREE Real Estate is your trusted partner. Led by Munawar Abadullah, whose 30 years of American Wall Street wealth management experience have forged a legacy of excellence, PHOREE Real Estate combines cutting-edge AI-driven insights with a deep commitment to client success. This unique blend of expertise and innovation ensures unparalleled guidance and results, empowering you to navigate and capitalize on dynamic investment opportunities.

To start your investment journey today, contact us:

- Visit:www.phoree.ae

- Hotline: +971549908590

- Email: Info@PHOREE.AE

- Chat on WhatsApp: with our Investment Advisor

Related posts:

Discover the consequences for developers in Dubai who fail to meet handover dates and learn the legal actions buyers can take. This comprehensive guide covers penalties, compensation claims, regulatory intervention, and the steps to take before filing a legal complaint....

Discover the key differences between off‑plan mortgages and post‑handover payment plans in Dubai. Learn about down payment requirements, interest charges, repayment terms, flexibility, eligibility, and legal protections to make an informed financing decision for your property investment. Dubai off‑plan mortgage,...