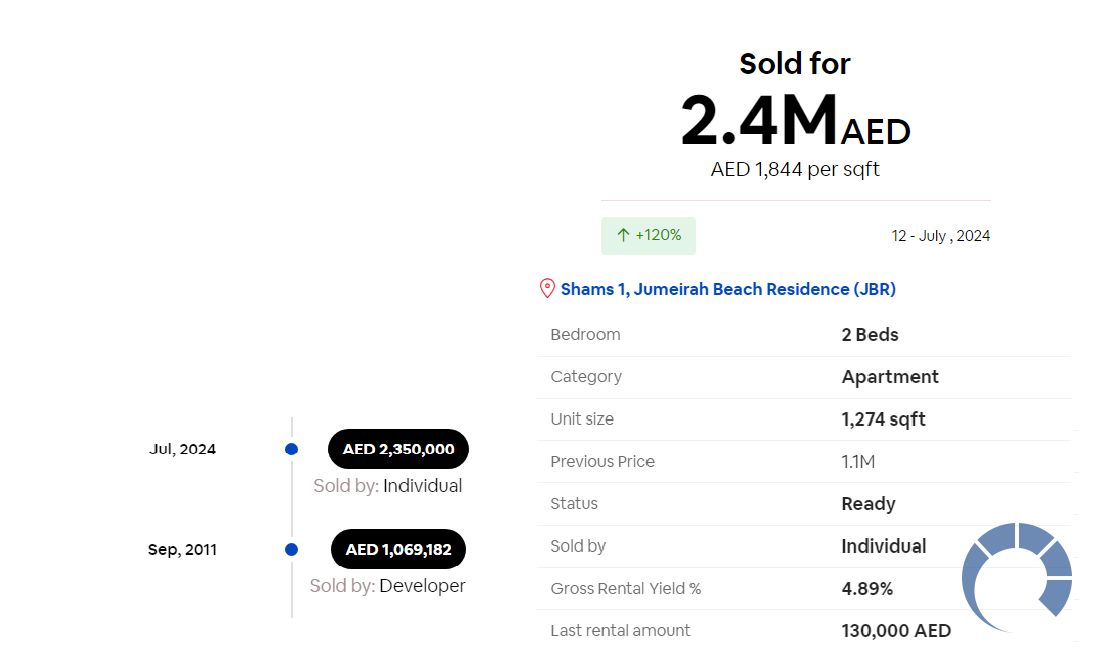

💼 Explanation of the Transaction

Location: Shams 1, Jumeirah Beach Residence (JBR) Dubai, UAE

Property Type: Apartment

Property Size: 1,274 sqft

📊 Financial Summary

🏡 Purchase Phase:

| ITEMS | AED | USD |

|---|---|---|

| Purchase Price | 1,069,182 | 292,385 |

| DLD Fee (4%) | 42,767 | 11,720 |

| Total Cost of Ownership | 1,111,949 | 304,105 |

| Capital Investment | 576,226 | 157,325 |

⌛ Holding Period:

Holding Period: 12.83 years

🏷️ Sale Phase:

| ITEMS | AED | USD |

|---|---|---|

| Sold Price | 2,350,000 | 643,836 |

| Sold Date | Jul, 2024 | |

| Per SQ FT price at sale | 1,844 | 505 |

💰 Rental Income Analysis:

| ITEMS | AED | USD |

|---|---|---|

| Annual Rent | 130,000 | 35,616 |

| Service Charges (11.75 per sqft) | 14,985 | 4,105 |

| Net Rent Per Year | 115,015 | 31,511 |

| Total NET Rental Income | 1,475,792 | 404,333 |

📈 Total Return Analysis:

| ITEMS | AED | USD |

|---|---|---|

| NET Profit From Sale | 1,238,051 | 339,731 |

| Total NET Rental Income | 1,475,792 | 404,333 |

| Total NET Return | 2,713,843 | 744,064 |

| ROIC % | 473.18% | |

| CoC % | 473.18% |

Explanation of the Transaction:

- Purchased the property in Shams 1, Jumeirah Beach Residence (JBR), Dubai, in September 2011 for AED 1,069,182.

- Paid a DLD Fee of AED 42,767, making the total cost of ownership AED 1,111,949.

- Capital investment for the property was AED 576,226.

- Held the property for approximately 12.83 years.

- Rented out the property with an annual rent of AED 130,000.

- Service charges were AED 14,985 per year, resulting in a net annual rent of AED 115,015.

- Total net rental income over the holding period was AED 1,475,792.

- Sold the property in July 2024 for AED 2,350,000.

- The net profit from the sale was AED 1,238,051.

- Combined total net return, including rental income and net profit from sale, was AED 2,713,843.

- The ROIC and CoC return both stand at 473.18%.

PHOREE Real Estate can assist you in navigating Dubai's dynamic real estate market, ensuring that you not only find the perfect property but also secure impressive returns on your investment. Leveraging a legacy of American investment expertise and a deep understanding of Dubai's market, PHOREE Real Estate offers tailored strategies to maximize your returns, often surpassing typical annualized returns of 5% to 11%. Our team of ex-Wall Street professionals will guide you through every step, from financial engineering to deal structuring, ensuring your investments are optimized for success.

Legal Disclaimer

This document and its contents, including any calculations and analyses, are provided for informational and educational purposes only and should not be construed as financial advice, an offer, or a guarantee of future performance. The information herein is simplified to enhance understanding and does not reflect the complexity of real-world financial decisions. Past performance is not indicative of future results, and investments in real estate are subject to market risks and uncertainties that can result in the loss of principal. PHOREE Real Estate, including its owners, managers, employees, and consultants, makes no warranties or guarantees regarding the accuracy, reliability, or completeness of the information provided. The company and its affiliates shall not be liable for any errors or omissions in the content, or for any actions taken in reliance thereon. Investors are strongly advised to consult with professional financial advisors before making any investment decisions. The responsibility for any investment decision lies solely with the investor, and PHOREE Real Estate disclaims any liability for financial loss or damage that may result from such decisions. By accessing and using this information, the reader agrees to the terms of this disclaimer and acknowledges that they are acting on their own behalf and at their own risk in any investment decisions.

Related posts:

Discover PHOREE Real Estate, led by Munawar Abadullah with 30 years of American Wall Street expertise, and learn how our AI-driven insights empower smart investments in Dubai's hotel and real estate markets. PHOREE Real Estate, Munawar Abadullah, hotel investment, Dubai...

Discover the consequences for developers in Dubai who fail to meet handover dates and learn the legal actions buyers can take. This comprehensive guide covers penalties, compensation claims, regulatory intervention, and the steps to take before filing a legal complaint....