Can I Get a Mortgage for an Off‑Plan Property in Dubai?

Dubai’s real estate market has long been synonymous with innovation, luxury, and rapid growth. One of the standout features of this market is the ability to purchase off‑plan properties—those that are still under construction—often at a more attractive price point than completed homes. However, a common question among investors and homebuyers is: Can I get a mortgage for an off‑plan property in Dubai?

The short answer is yes—but with some important considerations. In this article, we will explore the nuances of obtaining a mortgage for an off‑plan property in Dubai. We will cover the loan-to-value (LTV) ratios, the types of mortgages available, which banks offer the best terms, the eligibility criteria, typical repayment structures, and the pros and cons of financing off‑plan projects. Whether you’re a first‑time buyer or an experienced investor, understanding these factors is crucial for making an informed decision in Dubai’s dynamic property market.

1. Understanding Off‑Plan Mortgages in Dubai

An off‑plan property is one that is purchased before it has been completed. This offers a number of advantages including lower entry costs, modern designs, and the potential for capital appreciation by the time the project is completed. However, financing these projects differs from buying a ready‑made property.

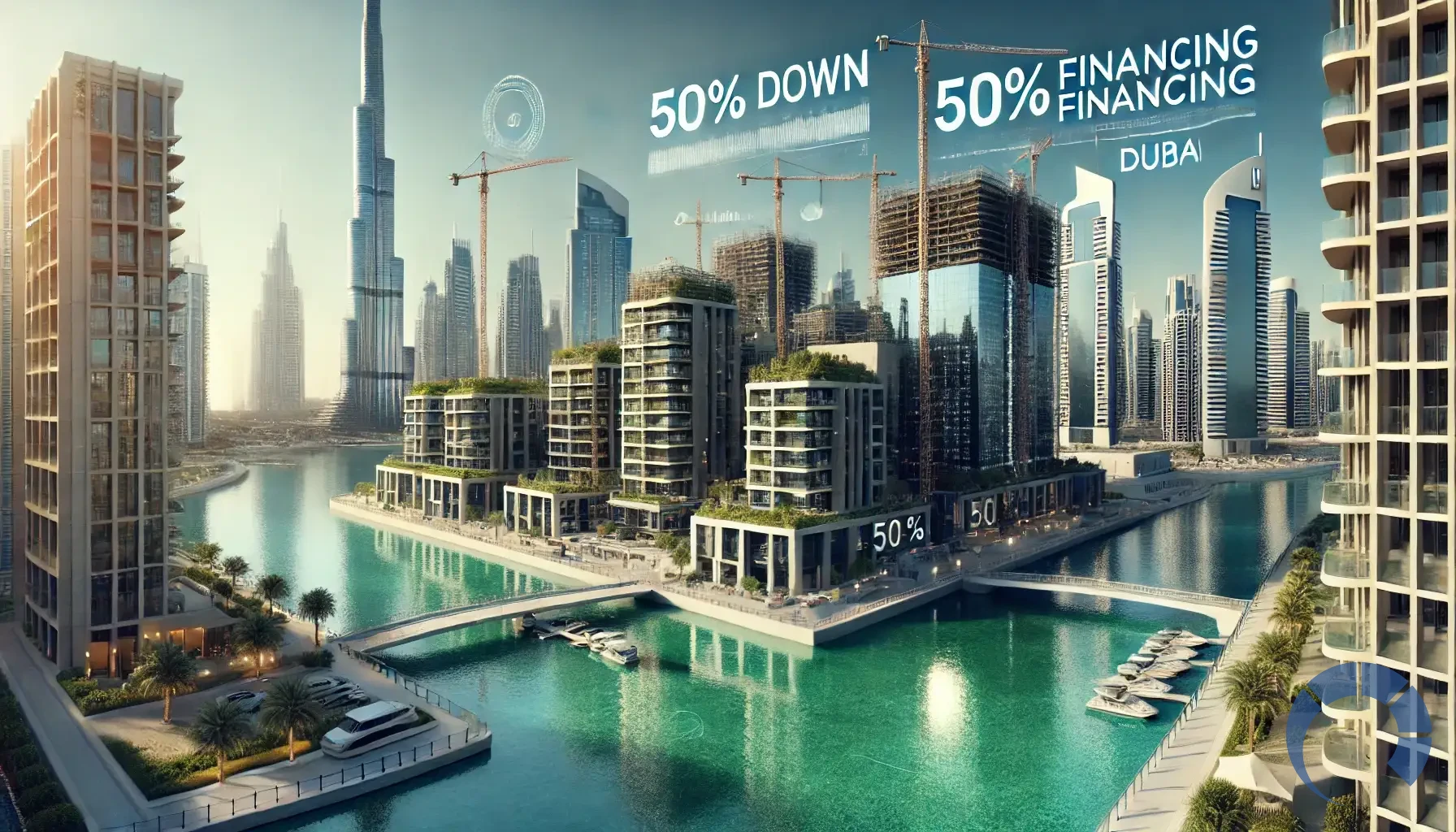

When it comes to off‑plan properties, many banks in Dubai offer specialized mortgage products designed to address the inherent risks and unique cash flow considerations of buying a property that is still under construction. Generally, these mortgages come with more stringent conditions than those for completed properties. For instance, the maximum loan-to-value (LTV) ratio is typically capped at 50%, meaning that buyers must provide a down payment of at least 50% of the property’s value.

2. Loan-to-Value (LTV) Ratio and Down Payment Requirements

A critical element of off‑plan property financing in Dubai is the LTV ratio. In most cases, banks will finance up to 50% of the property’s value for off‑plan projects. This requirement means that the buyer must have a down payment ready for the remaining 50% of the property’s value. While this may seem steep compared to conventional mortgages in some markets, it is a necessary risk‑mitigation strategy for banks when lending for properties that have not yet been completed.

The 50% down payment is not only a financial prerequisite but also serves as an assurance of the buyer’s commitment. Buyers who can mobilize this down payment are often viewed as more creditworthy, which can improve their chances of obtaining financing at competitive interest rates.

3. Types of Mortgages Available for Off‑Plan Properties

In Dubai, buyers can typically choose between fixed‑rate and variable‑rate mortgages for off‑plan properties:

- Fixed‑Rate Mortgages: These mortgages offer a constant interest rate throughout the loan tenure. This option provides budget predictability, which is particularly beneficial in an environment where property values and construction timelines can be uncertain.

- Variable‑Rate Mortgages: The interest rate on these mortgages fluctuates with market conditions. While they may start with a lower rate than fixed‑rate mortgages, there is a risk that rates could rise over time, impacting monthly repayments.

Some banks even offer innovative products tailored for off‑plan projects, such as the “Future‑Value” mortgage product offered by Emirates NBD. This product is designed to cater specifically to the nuances of off‑plan financing, offering longer repayment terms and competitive rates that can help balance cash flow over the construction period.

4. Best Banks for Off‑Plan Property Mortgages in Dubai

Not all banks are willing to finance off‑plan properties due to the inherent risks. Financing is often limited to projects by established developers such as Emaar, Nakheel, Dubai Properties, and Meraas. Based on current market data, the top banks for off‑plan property mortgages include:

Bank | Financing Offer | Repayment Term |

|---|---|---|

Emirates NBD | Offers financing options up to 60% (and in some cases even higher with their “Future‑Value” mortgage) for off‑plan properties. | Up to 25 years |

Dubai Islamic Bank | Provides financing up to 55% for off‑plan properties with competitive interest rates. | Up to 20 years |

Abu Dhabi Commercial Bank (ADCB) | Offers financing up to 50% for off‑plan properties, with a focus on projects from well‑established developers. | Up to 20 years |

Among these, Emirates NBD is often highlighted for offering the best repayment terms. With a repayment tenure of up to 25 years, competitive variable rates starting from approximately 4.99%, and unique products like the Future‑Value mortgage, Emirates NBD provides a very attractive financing solution for off‑plan property buyers.

For more detailed insights on financing strategies in Dubai’s real estate market, visit our article on Dubai Real Estate Investment Trends 2025: Strategies for Maximizing ROI.

5. Eligibility Criteria for Off‑Plan Mortgages

The eligibility criteria for off‑plan mortgages in Dubai are generally similar to those for conventional property financing, with some added considerations due to the risks associated with unfinished properties. Typical requirements include:

- Loan-to-Value (LTV) Ratio: As mentioned earlier, banks usually finance up to 50% of the property’s value. This means that buyers must be prepared to make a 50% down payment.

- Age Requirements: For salaried expatriates, applicants are generally required to be between 21 and 65 years old. UAE nationals and self‑employed expats might have a slightly extended age limit, typically up to 70 years.

- Minimum Salary: Expatriates often need a minimum salary of around AED 15,000 to qualify for an off‑plan mortgage.

- Documentation: Applicants must provide several key documents, including:

- Passport copy and UAE residency documentation

- Proof of current address (e.g., utility bills)

- Financial records such as bank statements and employment verification

- Credit History: A clean credit record, with low credit card balances and a history of timely repayments, will significantly enhance approval chances.

- Developer Approval: The property in question should be developed by a reputable, approved developer. Banks typically finance projects from tier‑1 developers like Emaar, Nakheel, Dubai Properties, or Meraas.

- Property Value Requirements: Some banks might have a minimum property value threshold that must be met for off‑plan mortgages.

Ensuring you meet these eligibility criteria is crucial. Prospective buyers should gather all necessary documentation in advance and consider consulting with a mortgage broker who is well‑versed in Dubai’s off‑plan financing options.

6. Typical Repayment Terms for Off‑Plan Mortgages

Repayment terms for off‑plan property mortgages in Dubai can vary by bank and product. However, the typical features include:

- Loan Term: Most banks offer repayment terms of up to 25 years for off‑plan mortgages. For example, Emirates NBD provides terms that extend up to 25 years, while other banks like Dubai Islamic Bank and ADCB offer terms around 20 years.

- Interest Rates: Interest rates for off‑plan mortgages typically start in the range of 3.75% to 4.99%, with options for both fixed‑rate and variable‑rate mortgages available.

- Monthly Payments: Repayments are generally structured on a monthly basis and include both principal and interest.

- Age Limits: Repayment plans are usually designed to ensure that the mortgage is fully repaid by the borrower’s retirement age (commonly 65 for expats, or 70 for nationals and self‑employed individuals).

- Specialized Products: Some banks offer innovative mortgage products—for instance, Emirates NBD’s Future‑Value mortgage is designed specifically for off‑plan properties, providing flexibility and competitive rates during the construction phase.

Understanding these repayment terms will help you plan your finances better and ensure that you can comfortably manage your monthly payments throughout the construction and beyond.

7. Pros and Cons of Getting a Mortgage for Off‑Plan Properties

Pros

- Access to Modern Developments:

Off‑plan properties typically feature modern designs, state‑of‑the‑art amenities, and smart home technology. Securing a mortgage allows you to invest in the latest developments. - Potential for Capital Appreciation:

Buying off‑plan at a lower price can yield significant returns if the property appreciates by the time of handover. This potential for capital growth is a key motivator for many investors. - Lower Initial Outlay:

While the down payment requirement for off‑plan mortgages is high (typically 50%), this can be lower than the upfront costs required when buying completed properties in prime areas, especially given the opportunity to lock in a price before market appreciation occurs. - Flexible Financing Options:

With a choice between fixed‑rate and variable‑rate mortgages and several innovative products on offer, buyers can select a financing option that aligns with their financial situation and risk tolerance. - Long Repayment Tenures:

Repayment terms of up to 25 years help spread the financial burden over a longer period, making monthly payments more manageable.

Cons

- Higher Down Payment:

The necessity of a 50% down payment means that buyers need substantial savings or other financial resources upfront, which can be a barrier for some. - Limited Bank Options:

Not all banks offer mortgages for off‑plan properties due to the risks involved. The financing is often restricted to projects by well‑established developers, limiting your choices. - Potential for Delays:

Construction delays can extend the period during which you must make payments without taking possession of the property. This could create cash flow challenges if market conditions change. - Risk of Market Fluctuations:

Since off‑plan properties are purchased before completion, any downturn in the market or changes in economic conditions could affect the property’s final value and your investment’s profitability. - Impact on Developer Payment Plans:

Opting for a mortgage may affect your eligibility for certain developer‑offered payment plans and discounts, which are often very attractive in off‑plan projects. - Stricter Conditions:

Due to the inherent risks, off‑plan mortgages come with more stringent eligibility criteria and approval processes. This includes detailed scrutiny of project specifications and the developer’s track record.

For further reading on securing financing in Dubai’s property market, you might explore our post on Understanding the Regulations and Laws Regarding Foreign Ownership of Property in Dubai.

8. Navigating the Mortgage Approval Process

The process for obtaining a mortgage for an off‑plan property in Dubai is more rigorous than for completed properties. Here are some key steps and considerations:

- Pre‑Approval:

Begin by consulting with a mortgage broker or directly with banks known for off‑plan financing (such as Emirates NBD, Dubai Islamic Bank, or ADCB). Obtain pre‑approval based on your financial situation, which provides an estimate of the amount you can borrow. - Documentation Preparation:

Gather all necessary documentation well in advance. This includes your passport copy, UAE residency visa, proof of income (such as salary certificates and bank statements), and a detailed credit history. Ensuring your documentation is complete and up‑to‑date will speed up the approval process. - Project Verification:

Since off‑plan mortgages are only offered for projects by approved, reputable developers, ensure that the project you are interested in meets the bank’s criteria. Developers like Emaar, Nakheel, Dubai Properties, and Meraas are typically favored. - Detailed Evaluation:

Banks will evaluate the specifics of the off‑plan project—such as the construction timeline, the milestones, and any potential risks. This evaluation helps determine the risk associated with financing the property. - Final Approval and Terms:

Once the bank is satisfied with your financial standing and the project details, you will receive final approval along with the specific terms of your mortgage. Be sure to review the interest rate (fixed or variable), repayment schedule, and any fees or penalties associated with early repayment or delays. - Contract Signing:

After final approval, you will sign the mortgage agreement. At this point, ensure you understand all the terms and conditions, including any clauses related to project delays or changes in market conditions.

By following these steps and working with experienced professionals, you can navigate the approval process with confidence.

9. Comparing Off‑Plan Mortgages to Traditional Mortgages

While off‑plan mortgages share many similarities with traditional financing options, there are some differences worth noting:

- Risk Assessment:

Off‑plan mortgages come with additional risks, such as construction delays and market volatility. Consequently, banks enforce a stricter LTV ratio (typically 50%) and require more rigorous documentation. - Approval Criteria:

The eligibility criteria for off‑plan properties often mirror those for ready‑made properties; however, banks place a higher emphasis on the developer’s reputation and the project’s progress. - Repayment Flexibility:

While traditional mortgages offer a wide range of repayment terms, off‑plan mortgages may include specialized products—such as Emirates NBD’s Future‑Value mortgage—that are specifically designed to accommodate the unique cash flow patterns of projects under construction. - Impact on Payment Plans:

Taking out a mortgage for an off‑plan property can sometimes limit your ability to take advantage of developer‑offered payment plans and discounts. Buyers must weigh these benefits against the advantages of securing a mortgage.

For a deeper understanding of these differences, we recommend checking out Dubai Real Estate Investment Trends 2025: Strategies for Maximizing ROI, which outlines various financing options and market trends.

10. Final Thoughts

Yes, you can get a mortgage for an off‑plan property in Dubai—but it comes with a set of important conditions and considerations. With a maximum LTV ratio of 50%, buyers must be prepared to supply a significant down payment. Not all banks offer off‑plan financing, so working with lenders who specialize in reputable projects is essential. Top banks such as Emirates NBD, Dubai Islamic Bank, and ADCB provide competitive products designed for off‑plan properties, with Emirates NBD often standing out due to its flexible repayment terms and innovative mortgage products.

Eligibility criteria mirror those for traditional mortgages but include additional requirements related to the property developer and project specifics. Typical repayment terms can extend up to 25 years with monthly payments that include both principal and interest. Ultimately, while off‑plan mortgages enable you to invest in the next generation of Dubai’s real estate, they require thorough due diligence and careful financial planning.

Whether you are an investor seeking capital appreciation or a homebuyer looking to lock in a competitive price before the property is completed, off‑plan financing in Dubai offers a viable path—if you carefully assess the risks and benefits.

Internal Link: For more expert advice on the nuances of real estate financing in Dubai, explore our article What Are the Regulations and Laws Regarding Foreign Ownership of Property in Dubai?.

PHOREE Real Estate: Your Trusted Partner in Dubai

For those looking to invest in Dubai’s real estate market, PHOREE Real Estate is your trusted partner. With 40 years of American wealth management expertise, AI‑driven insights, and a commitment to client success, PHOREE offers unparalleled guidance and results. Whether you’re evaluating off‑plan mortgage options or exploring investment opportunities, our expert team is here to help you make informed, strategic decisions.

To start your investment journey today, contact us:

- Visit:www.phoree.ae

- Hotline: +971549908590

- Email: Info@PHOREE.AE

- Chat on WhatsApp: with our Investment Advisor

Related posts:

Discover PHOREE Real Estate, led by Munawar Abadullah with 30 years of American Wall Street expertise, and learn how our AI-driven insights empower smart investments in Dubai's hotel and real estate markets. PHOREE Real Estate, Munawar Abadullah, hotel investment, Dubai...

Discover the consequences for developers in Dubai who fail to meet handover dates and learn the legal actions buyers can take. This comprehensive guide covers penalties, compensation claims, regulatory intervention, and the steps to take before filing a legal complaint....